Turning Liabilities into Assets and How to Put Them for Rent on Pairables: In today’s fast-paced world, where financial stability is of paramount importance, people are constantly seeking ways to make their assets work for them. One innovative approach to achieving financial opportunity is by turning liabilities into assets. This article explores the concept of transforming liabilities into income-generating assets and how to leverage the power of the online platform “Pairables” to put these assets up for rent. If this gets your thinking wheels going you should certainly read the book “Rich Dad, Poor Dad” by Robert Kiyosaki. He is the author of more than 26 books, including the international self-published personal finance Rich Dad Poor Dad series of books which has been translated into 51 languages and sold over 41 million copies worldwide.

Understanding Liabilities and Assets

Before venturing into converting liabilities into assets, it is crucial to understand the fundamental difference between the two. Liabilities are financial obligations or debts that drain money from your pocket. Examples include personal loans, mortgages, credit card debts, or any recurring payments that lead to negative cash flow.

On the other hand, assets are items of value that can generate income and appreciate over time. These can include real estate rentals, dividends, machinery, land, or any other possessions that have a market demand. Also by turning liabilities into assets, individuals can generate passive income and work towards building wealth. Keep in mind that the above-mentioned objects also can be devalued and only become an asset when they start to create a continuous cash flow and add additional income.

The Importance of Financial Diversification

Financial experts emphasize the importance of diversifying one’s income streams. Relying solely on a salary or a single source of income can be risky, as economic fluctuations or unforeseen circumstances may impact your financial stability.

Having a diversified portfolio of income-generating assets provides a safety net during tough times and boosts financial resilience. By converting liabilities into assets and putting them up for rent, individuals can create a diversified income stream that is less susceptible to market volatility. Please connect to your financial advisor for your personal needs, this article is written to explain the opportunities for you to rent out items you already own and take care of.

Identifying Potential Liabilities to Convert

Assessing Personal Possessions

Many people accumulate various possessions over the years that they rarely use. These items can include electronics, furniture, collectibles, and other personal belongings. By identifying possessions with market demand and converting them into rentable assets, individuals can monazite their underutilized belongings. This is the most crucial part of your approach to what you already own and store: Think about your camping items, fishing gear, snowshoes, decorations, generator, tools, paddle board, or that bouncy castle that got only used for last year’s party.

The Benefits of Renting Assets

Generating Passive Income

Renting assets allows individuals to generate passive income without significant additional effort once the rental listings are established. Also, this extra income can be a valuable supplement to regular earnings. The options are unlimited, create a good ad and include pictures or videos to attract more attention. Pricing can be adjusted per hour, day, weekend, or longer. This allows you to provide the best deal for your renter and your personal additional income.

Utilizing Underutilized Assets

By renting out underutilized assets, individuals can maximize the value of their possessions and make the most of their investments. We all collect items for the classic “maybe I’ll need it one day”. Are you ready for the next natural disaster but your neighbour down the valley isn’t? This might be the moment to rent out that generator, water dike, pump, sprinkler, or on a happier note a tent, BBQ, or inflatable ball pit, the sky is the limit as soon as you are keen to participate.

Decreasing Financial Burden

Generating income from rented assets can offset the costs of owning and maintaining them, reducing the financial burden on the asset owners. The more you rent them out the more you gained back. All things considered, there always will be wear and tear on items, include this in your calculations. Luckily on this rental platform, there is a damage deposit to cover you for any inconveniences of items breaking. On top of that Pairables keeps a record of all members signing up with a third-party verification system.

Introducing Pairables: An Online Rental Platform for Everyone

What is Pairables?

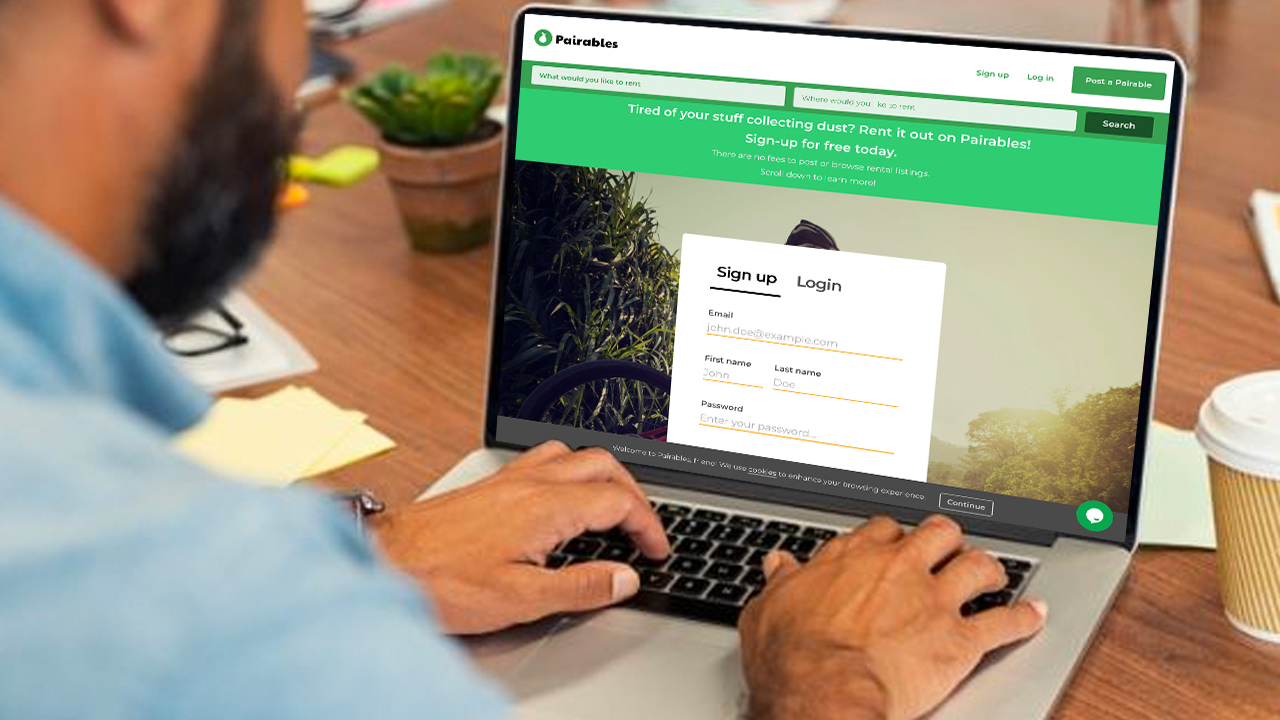

Pairables is a leading online platform that connects asset owners with potential renters. It provides a user-friendly interface for listing assets and managing rental transactions. Create an account today and become part of this community free of charge. Another key point to consider is local exchange and recycling vs having to purchase more for each adventure.

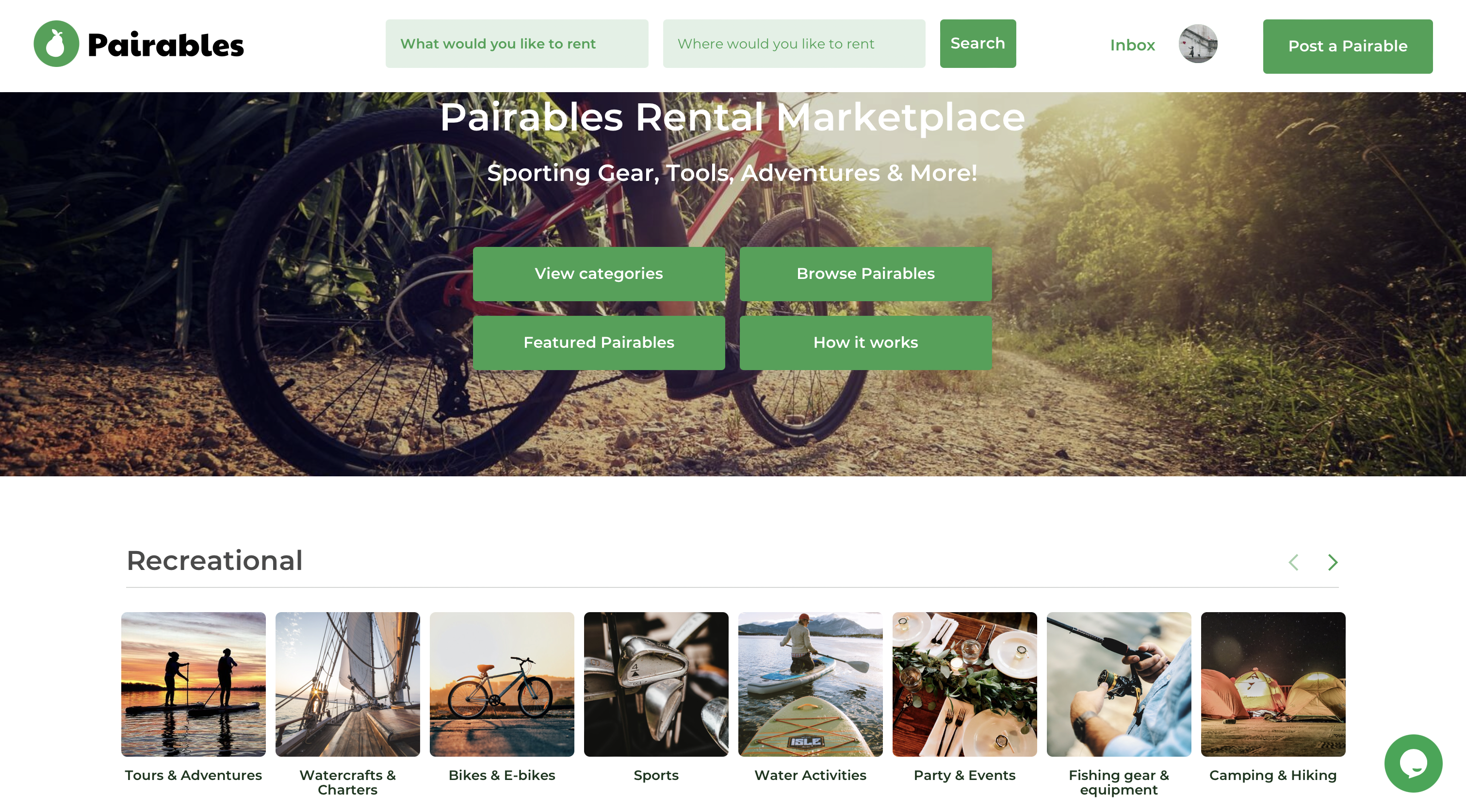

How Does Pairables Work?

Asset owners can create detailed listings with descriptions, images, rental rates, and availability. Renters can search for assets based on location, type, and other criteria, and contact owners to initiate rental agreements.

Best Practices for Renting on Pairables

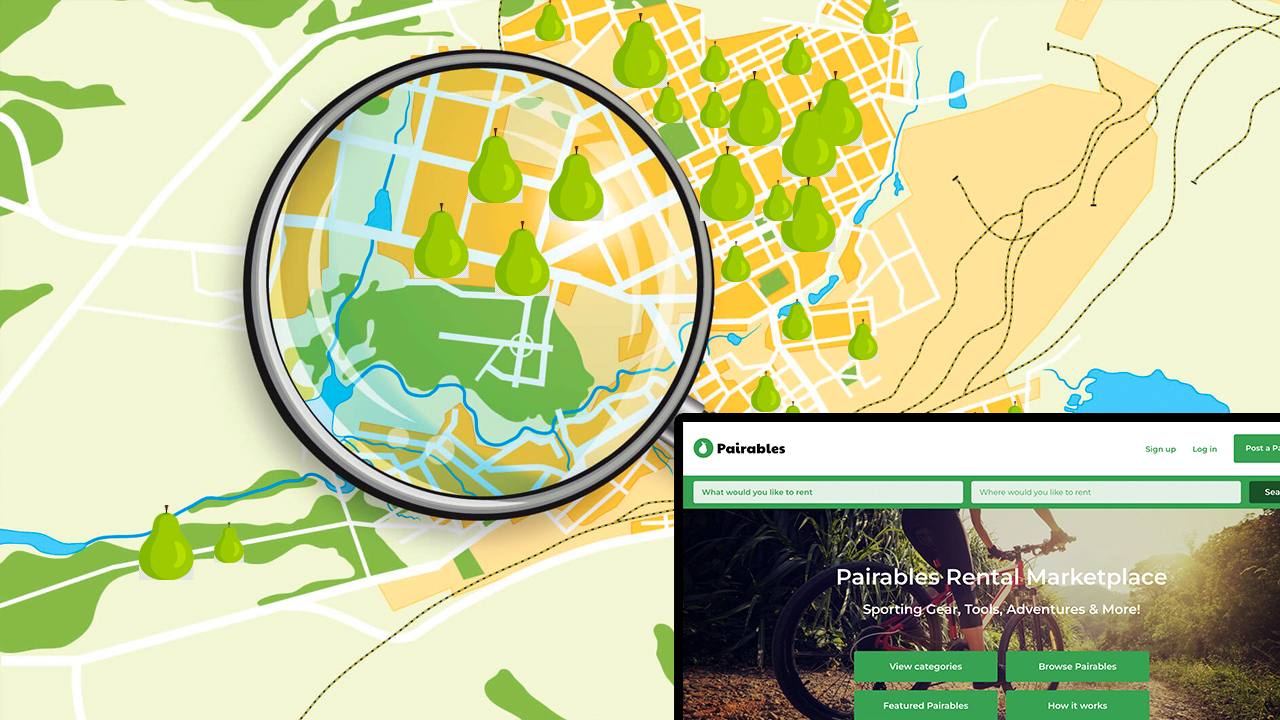

High-Quality Listing Descriptions and Images

Creating engaging and informative listings with high-quality images helps attract potential renters and increases the chances of rental success. When creating a listing on Pairables, it’s essential to provide accurate and comprehensive details about the item. This includes clear images, rental terms, and any specific requirements for renters, the Pairables platform will guide you easily though a couple of steps.

Flexible Rental Terms

Offering flexible rental terms, such as short-term or long-term options, can cater to a broader range of renters and increase the asset’s rental potential.

Conclusion: Turning Liabilities into Assets on Pairables

As a result, turning liabilities into assets through rental opportunities is a powerful way to enhance cash flow. Finally, by leveraging the potential of this online rental platform, individuals can tap into a wide market of potential renters and convert underutilized possessions into income generators. Embrace the possibilities of transforming liabilities into assets and unlock new avenues of income big or small.

To learn more about the business approach of turning Liabilities into assets, order the book on Amazon called “Rich Dad, Poor Dad”.